First-Time Wealth Builder

Is a financial planning service for high income earning, not wealthy yet individuals who have

less than $500k saved and want to achieve financial freedom.

First-Time Wealth Builder is for you if...

- You are ready to take action in your finances

- You are the first in your family to earn a high income

- You want to create the financial peace of mind you didn't have growing up

- You want to work with someone who understands the importance of financial stability

- You grew up in a community that didn't teach the power of financial literacy

- You are making more money than ever, but your wealth isn't growing

- You are a great saver and you are ready to take your finances to the next level

Imagine If...

- You became the first in your family to achieve financial freedom

- You protect your hard earned money while building a legacy

- Your wealth journey is a weight off your shoulders

- You have a strong sense of financial control and security

- You're living the life you have always dreamed

- 100% of your energy is focused on the things that matter most to you

The First-Time Wealth Builder Path:

1. Free Introductory Meeting

- Complimentary 30-minute meeting for you to ask any questions.

- Our goal is to understand if our solutions can help you.

2. Free Discovery Meeting

- Complimentary 60-minute meeting to help identify and prioritize your financial goals.

- We take a deep-dive into your finances by covering: cash flow, debt, savings, real assets, and investments.

3. Onboarding Meeting

- We review our Client Agreement to officially become a client!

4. Plan Delivery Meeting

- We present your personalized financial plan and explain the why behind every recommendation.

- We illustrate where you are in your financial journey and cover step-by-step recommendations to get you to where you want to be.

5. Implementation Meetings

- We take action on your financial plan by breaking it down into sections and implement changes to the following:

- Cash Flow/Debt Reduction

- Investments & Diversification

- Risk Analysis (including employer benefits)

- Tax Planning

- Estate Planning

6. Ongoing Meetings

- After we implement your plan, the most important part begins; monitoring. The reality is that your priorities and goals will change as life happens:

- Start/grow a family

- Caring for a family member

- Death of a family member

- Purchasing a home

- Start a business

- Go back to school/career change

- Hitting new income milestones

What's Included:

- 1:1 meetings that are tailored to your schedule

- In-between meeting support is available to help answer any questions or concerns

- A comprehensive financial plan that is based on your financial situation, goals, and values

- Financial planning + Investment management for one flat fee

- Personal client portal that tracks your budget, net worth, investments, and goal progress

- Transparent flat fee so you know exactly what you pay

- Fiduciary financial planning which means we are legally and ethically bound to act in your best interest. We don't receive commissions or sell you any products.

- Year-round accountability for those ready to stop procrastinating and start implementing wealth building strategies

- Year-round plan updates to adjust when life happens

- 5-8 Implementation meetings to setup your ideal financial health

- 2-6 Monitoring meetings per year to track your progress, review asset allocation, economic conditions, and so much more!

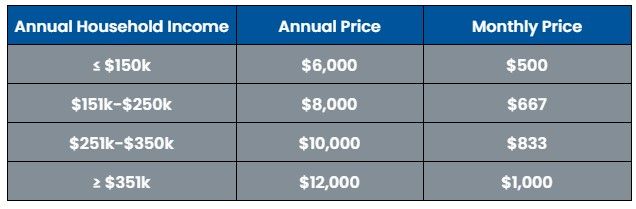

Pricing:

- First-Time Wealth Builder's annual fee is based on your household income.

- We have no minimum requirements for Assets Under Management (AUM).

Let's Transform Your Financial Future Together...

- Goal Setting: Gain clarity on your financial goals.

- Emergency Fund: Establish and build an ideal emergency fund.

- Debt Reduction: Step-by-step recommendations on paying off debt.

- Retirement Planning: Identify which retirement account(s) are best to start building wealth.

- Customized Asset Allocation Strategies: Actionable feedback with choosing investments based on risk tolerance while minimizing fees & expenses and diversifying your portfolio.

- Tax Planning: Analyze your tax situation and reduce tax liability to accumulate wealth much faster.

- Risk Management: Identify and fill gaps within your life, disability, property & casualty, professional/business, and health insurance coverages.

- Estate Planning: Help protect your assets and the financial well-being of your loved ones by connecting you to a vetted estate planning attorney.

- Education Planning: Identify which education account best meets your families' education funding goals.

- Business Planning: Help integrate your personal and business finances to save on taxes and grow your business.

- Employer Benefit Analysis: Help maximize your employer benefits.

- And so much more!